Dewey & LeBoeuf’s bankruptcy

Inmates running the asylum — The firms bankruptcy is much more than the story of a partnership gone wrong

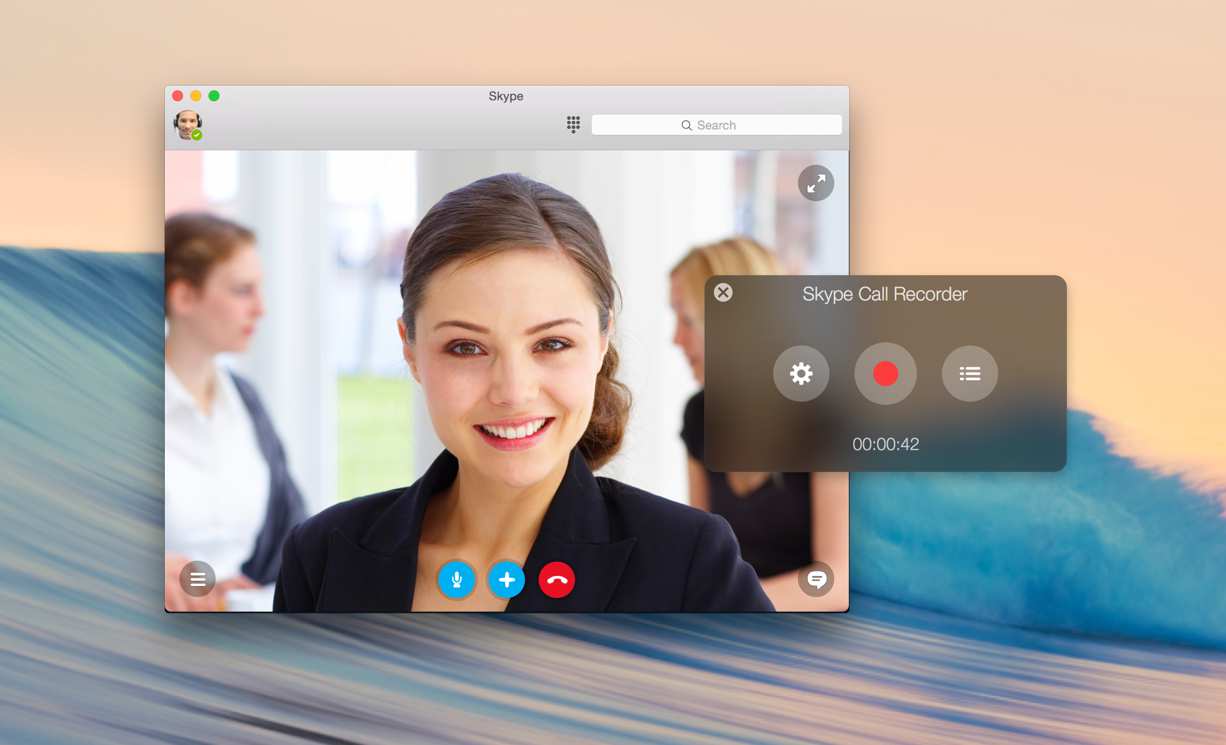

IT WAS always an awkward coincidence that the cousin of Steve DiCarmine, … a former executive at the collapsed law firm Dewey & LeBoeuf (pictured), was “Vinny Gorgeous” Basciano, who ran the Bonnano crime family and is now serving a life sentence in federal prison. Yet according to a 106-count indictment released on March 6th by New York prosecutors, Mr DiCarmine was somewhat of a gang leader himself. He allegedly participated in a criminal conspiracy to defraud the firm’s lenders—the dollar value of which dwarfs even the most lucrative schemes of his notorious relative. The demise in May 2012 of Dewey & LeBoeuf, which once employed 3,000 attorneys people and left its creditors on the hook for $550m in claims, was widely seen as a cautionary tale of partnership dysfunction and mismanagement following an ill-advised merger. The state’s version of events is far more sinister: rather than simply making poor business decisions, the firm’s leaders knowingly falsified its accounts, Enron-style, in a vain effort to keep it afloat.

Вернуться на Главную

The root causes of Dewey & LeBoeuf’s implosion, particularly its campaign to lure high-grossing “rainmaker” lawyers from rivals by offering lucrative guaranteed contracts, are well-known and were detailed at length in a New Yorker feature last year. Whereas the indictment does not address the run-up to the firm’s financial squeeze, the charges do imply that it might have gone under far earlier had its management not resorted to an impressive array of accounting shenanigans. As early as 2008, the prosecutors allege, Dewey & LeBoeuf had breached a loan covenant requiring it to post at least $290m in annual cash flow. Rather than advising its lenders of the bad news that it had missed the bar, the firm claimed it had cleared it by $4m.

Prosecutors charge that to derive this figure, the firm’s leaders — Steven Davis, the chairman; Joel Sanders, the chief financial officer; and Mr DiCarmine, the executive director — brought back onto the balance sheet bills they had previously written off as uncollectible and reclassified salaries as profit distribution to partners. As years went on and business further deteriorated, they allegedly exacerbated these manipulations by misrepresenting loan payments and partner capital infusions as fee income, backdating checks to meet financial requirements for prior years and double-counting certain revenues. They then relied on these false financial statements to conduct a $250m debt refinancing in 2010 with a group of banks and insurance companies. On the same day that the New York prosecutors announced the indictment, the federal Securities and Exchange Commission filed a separate civil complaint against the defendants regarding this bond offering.

The defendants’ lawyers insist that their clients have not committed any crimes. They accuse the state of looking for scapegoats, and note that Dewey & LeBoeuf’s auditor, Ernst & Young, signed off on its financial statements — a point that surely has that firm’s leadership squirming. (Enron’s accountant, Arthur Andersen, closed shop a few months after its problem client did.) But they may have a tough time convincing a jury to look past the salacious e-mail trail the defendants, who face up to 25 years in jail, left behind. They openly referred to millions of dollars’ worth of “accounting tricks” and “fake income” and called an auditor “clueless”. Mr Sanders once wrote “I don’t want to cook the books anymore”, before proceeding to continue with business as usual. And after a colleague completed a particularly effective massaging of the numbers, Zachary Warren, a former client-relations manager who was also charged, wrote “Nice work dude. Let’s get paid!”

Perhaps the most striking revelation in the indictment is that …